Jobs down globally, USA one of few to see increase in professional roles – as Trump’s policies begin to take effect

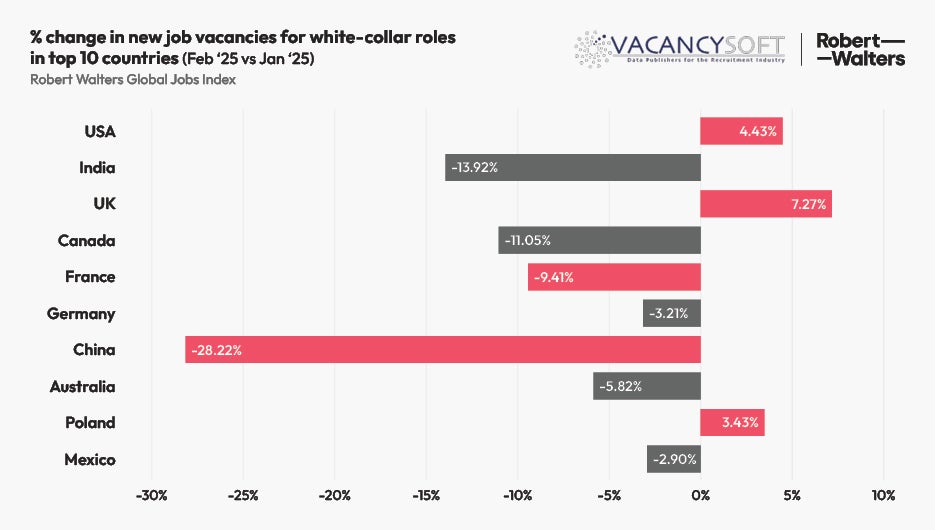

USA (+4.43%), UK (+7.27%), and Poland (+3.34%) were the only countries in Top 10 to post more white-collar vacancies in February vs January 2025

-8.29% decline in professional roles globally in February 2025 (vs Jan ’25)

Industrials (+9.83%), Energy & Utilities (+6.90%), and Consumer Goods & Services (+4.72%) were the only industries to post an increase in white-collar jobs in February (vs previous month)

Financial services posted more jobs this year (so far) when compared to the same period last year.

The USA posted a +4.43% increase in February ‘25 vs January ’25 – and was one of only three countries (in the top 10 for white-collar job volumes) to report an increase in new job vacancies last month.

By country, the USA continues to dominate in job creation across the world’s leading employers - accounting for 40% of all vacancies featured within the Robert Walters Global Jobs Index in 2025 so far.

Other key markets include the UK (10.20% share of February jobs in the Index), Canada (5.40%), and Germany (3.00%).

The findings come from Robert Walters Global Jobs Index, published today on Tuesday 18 March in partnership with Vacancysoft, and is the only index of its kind to track job flow for professional roles across the globe by looking at external job adverts posted online in real time.

Toby Fowlston, CEO of global talent solutions business Robert Walters, comments:

“These are some of the first sets of figures to indicate a small uptick in hiring pace as economic policies under the Trump administration begin to show possible signs of influencing business sentiment across certain industries. Whilst it is too early to ascertain the ‘why’ behind this increase – the next few months will be telling.”

Jobs Down Globally, but UK Holds Strong

Globally, February saw a -8.29% decline in professional (white-collar) job vacancies across all industries.

However, among leading economies, the UK was one of the only to report a +7.27% month-on-month increase – February ’25 vs January ’25 - while China (-28.22%) Canada (-11.05%), France (-9.41%), and Germany (-3.21%) saw declines.

Job growth in the UK can be put down to a stable financial services sector (+2.36% more job in Feb vs Jan), and a notable increase in new white-collar job adverts posted across energy & utilities, healthcare, basic materials, and the industrials industry.

Tech media & telecoms, consumer goods & services, professional services, and real estate all reported a dip in job roles in the UK in February.

Toby Fowlston – CEO of global talent solutions business Robert Walters comments:

While February presented challenges with an overall decrease in vacancies, we are starting to see a trend of ‘cautious optimism’ when it comes to market confidence.

“The financial services sector's projected growth and the USA's continued dominance underscore the evolving dynamics influenced by policy changes and economic shifts.”

‘Unexpected’ Resilience in Financial Services & Consumer Sectors

Growth was seen in: (Feb ’25 vs Jan ’25)

Industrials +9.83%

Energy & Utilities +6.90%

Consumer Goods & Services +4.72%

Despite an overall dip month-on-month, Financial Services (-7.80%) and Tech, Media & Telecoms (-5.41%) remain dominant in overall job volumes - making up 65% of total job vacancies in the Index.

Financial Services continues to show long-term strength, with more vacancies this year in January (+11.16%) and February (+3.47%) than the same months in 2024. At current pace, the sector is projected to end Q1 2025 up by +4.50% when compared to Q1 last year, indicating broad recovery across the global banking market.

In terms of one to watch within Financial Services, Poland is the only country to report an increase in vacancies month-on-month (Feb ’25 vs Jan ’25) and year-on-year (Feb ’25 vs Feb ’24); +5.83% and +16.9% respectively.

Toby comments: “Our Index shows continued job growth in financial services, particularly in India and Poland - a trend we've observed over the past 6-12 months. However as it stands, this hasn’t come at the expense of traditional banking hubs like the UK, Germany, and the US, where hiring has remained stable with no major declines in recent months.”

Sectors Slowing Down

In contrast, hiring across the Tech, Media & Telecoms sector (TMT) remains sluggish, with February 2025 marking the lowest vacancy levels since May 2024. Out of the top 10 countries for jobs in the TMT sector, the USA (+7.11%) was the only one to post an increase when comparing Feb ’25 to Jan ’25.

Meanwhile, Professional Services, particularly IT Consulting, saw a sharp month-on-month drop of -25.1% (Feb ’25 vs Jan ’25). However, this follows a record-breaking January, where vacancies were +31.75% above the previous six-month average.

Toby concludes: “As global markets adjust to shifting economic policies and geopolitical events, hiring trends remain in flux. However, the strong performance of some sectors in February – such as basic materials, energy & utilities, financial services and consumer goods & services – helps to set a more optimistic tone for Q2 2025.

For Media Enquiries:

Carmen Walker

PR Manager

E: Carmen.walker@robertwalters.com

T: 020 7509 8481

Related content

View AllFollowing the excellent turnout and discussion at our post-budget events, hosted by Stuart Nash, we're sharing the key highlights and insights below. As 2025 unfolds, New Zealand's labour market is embracing opportunities within an evolving economic and political landscape. The government's new "Gro

Read More20 May 2025. Global white-collar vacancies fall -11.6% in April 2025 compared to March 2025 Hiring for AI and data roles remains resilient – Machine learning vacancies grow +27% in April, with demand shifting toward infrastructure and engineering skills USA sees -16.2% drop in April 2025 vacancies v

Read MoreMarch Sees Global Uptick in Professional Job Growth, but future impact of US trade tariffs remains to be seen Global white-collar vacancies jump +31% in March 2025 compared to February 2025 across all industries following a month-on-month decline in February USA sees +38% rise in vacancies in March

Read More